philadelphia property tax rate 2019

091 of home value. However if you pay before the last day of February you are entitled to a 1 discount.

Don T Want The Extra Cash Here S How To Opt Out Of The Payroll Tax Deferral 6abc Philadelphia Payroll Taxes Payroll Deferred Tax

You can also generate address listings near a property or within an area of interest.

. Philadelphia performs well for commercial property tax rates compared to other cities in the nation according to a recent report. Tax rate for nonresidents who work in Philadelphia. Real Estate Tax Services City of Philadelphia.

The rate as of July 1 2019 for residents of Philadelphia decreases from 38809 to 38712 and the rate for nonresidents of Philadelphia decreases from 34567 to 34481. All real estate located in Philadelphia is assessed by the city of Philadelphias Office of. If you disagree with your property assessment you can file an appeal with the Board of Revision of Taxes BRT.

Houses 8 days ago The City offers a number of abatement and exemption programs for Real Estate TaxesThese programs include. Larry Eichel Thomas Ginsberg Read time. You can print a 8 sales tax table here.

Residential Property Taxes Likely. Philadelphia Makes Progress on Collecting Delinquent Property Taxes Noncollection rate dropped from 65 to 39 percent in five years outpacing other high-poverty cities improvement Article February 4 2019 By. Philadelphia property tax rate 2019.

Philadelphia collects the maximum legal local sales tax. Yearly median tax in Philadelphia County. The citys revaluation that took effect in 2019 saw a 105 increase in the median assessed value for a single-family home.

The 8 sales tax rate in Philadelphia consists of 6 Pennsylvania state sales tax and 2 Philadelphia County sales tax. Between 2018 and 2019 the median property value increased from 167700 to 183200 a 924 increase. Philadelphia property tax rate 2019.

Homestead Exemption for all Philadelphia homeowners who complete an application. Nonresidents who work in Philadelphia pay a local income tax of 350 which is 043 lower than the local income tax paid by residents. 06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as assessed by the Office of Property Assessment OPA.

Oct 11 2019. Then in early July 2017 wed gotten another notice. The delayed filing and payments could.

Of big US. Philadelphia is extending filing and payment dates for some business taxes until July 15 2020 in accordance with the federal extension provided by the IRS. For tax rates in other cities see Pennsylvania sales taxes by city and county.

Philadelphia County collects on average 091 of a propertys assessed fair market value as property tax. A new budget package with preliminary approval from City Council would nix a proposed 41 percent increase in Philadelphias property tax rate a measure that has been urged by Mayor Jim Kenney to. Examine our database of Philadelphia 2019 Property Assessments.

Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the Federal income tax. The City of Philadelphia wage tax is a tax on salaries wages commissions and other compensation paid to an employee who is employed by or renders services to an employer. Philadelphia Realty Transfer Tax rate increase is effective July 1 2018 Effective July 1 2018 the Realty Transfer Tax rate is increased to 4278 of the sale price or assessed value of the property plus any assumed debt.

Philadelphia leads largest cities in property tax breaks This map makes it easy topare your property tax change to your neighbors Your 2020 property tax bill is now delinquent Philadelphias ranking for property tax rate Types of Property Tax Exemptions Millionacres The Cost of Living in Philadelphia The countdown begins now. People in philadelphia county pa have an average commute time of 325 minutes and they drove alone to work. The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200.

2019 at 0118 PM. For example if your property is assessed at a 250000 value your annual property tax will be about 3497. This program reduces the taxable portion of your property assessment by 45000 in effect for.

So residents were shocked last week to learn that the 51 homes on the 2500 block of South Mildred nearly doubled in value overnight on paper as the city rolled. Use the Property App to get information about a propertys ownership sales history value and physical characteristics. Cities Philly had only the 27th-highest commercial property tax rate in 2017 and the 33rd-highest homeowner tax rate But the.

We owed 731 in Net Profits Tax a business tax plus 5117 in penalties and interest. At this value paying before the last day in February will save you around 35. That increased by an additional 31 for the last reassessment which was completed in 2019 and used for 2020 and 2021 tax bills.

There is no applicable city tax or special tax. Posted on January 20 2021 by. Pennsylvania is ranked 1120th of the 3143 counties in the United States.

The City of Brotherly Loves rate of 11 places it.

Loudoun S Data Center Tax Revenue Is Accelerating At An Insane Pace Washington Business Journal

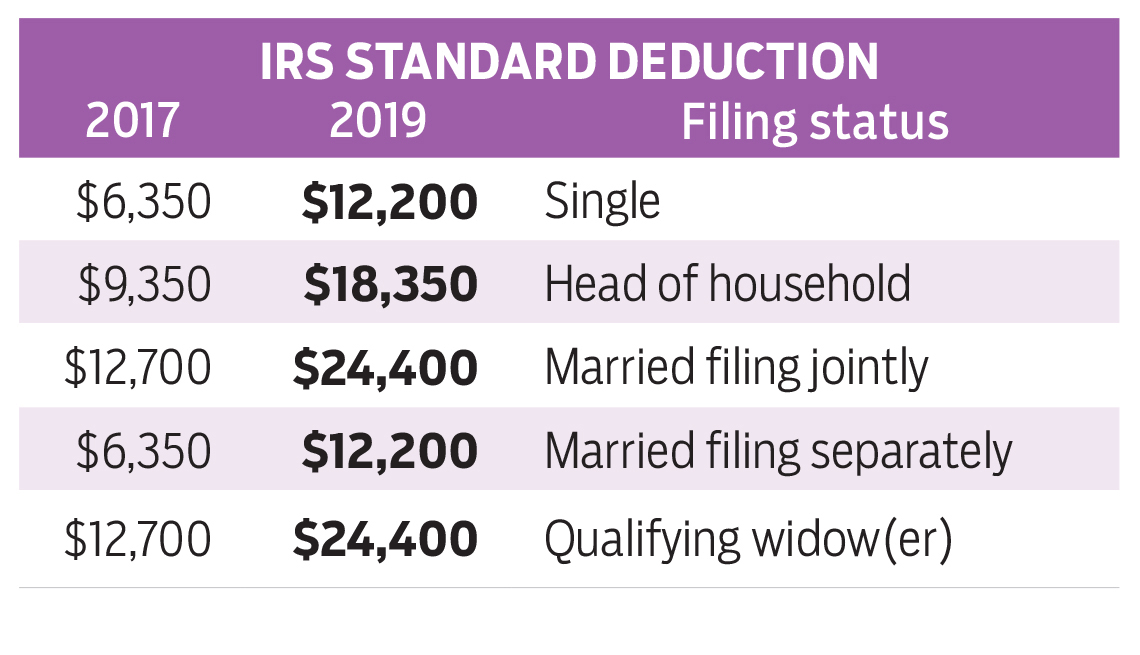

2018 Tax Deductions 9 Breaks You Can No Longer Claim When Filing Income Taxes Cbs News

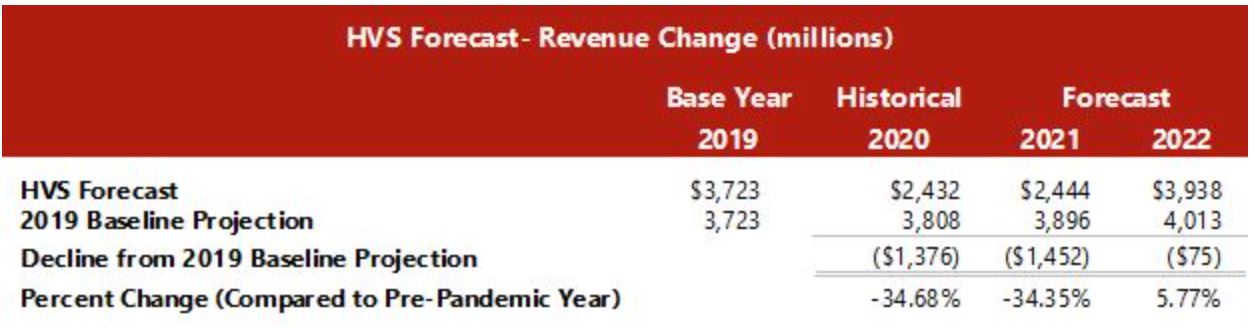

2021 Hvs Lodging Tax Report Usa By Thomas A Hazinski And Joseph Hansel

The 10 Most Affordable States In America States In America Map Best Places To Retire

Give To Charity But Don T Count On A Tax Deduction

U S Home Sellers Realized Average Price Gain Of 57 500 In First Quarter Of 2019 Down Slightly From Last Quarter Attom

How A Philadelphia Property Tax Issue Nearly Cost Us Our House

City Releases Property Tax Calculator To Assist Homeowners Department Of Revenue City Of Philadelphia

Several Tax Changes In 2019 To Affect Buy To Let Property Choosing A Career Entrepreneur Academy Education Related

2020 Pennsylvania Payroll Tax Rates Abacus Payroll

March Madness 2019 Real Estate Edition March Madness College Basketball Teams Real Estate

Pennsylvania Property Tax H R Block

Income Tax Deductions List Fy 2019 20 List Of Important Income Tax Exemptions For Ay 2020 21 Tax Deductions List Tax Deductions Income Tax

U S Foreclosure Activity In October 2019 Climbs Upward From Previous Month Attom

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Get The Right Mortgage With Florida S Largest Mortgage Lenders Mortgageflorida Tk Lowest Mortgage Rates Mortgage Rates Mortgage Lenders

Save Thousands Of Dollars In Taxes With A Student Visa Go Study Australia